Last week, Verona resident Alex Roman unveiled a proposal for an alternative municipal budget that would raise Verona taxes by 1.3% instead of the 6.5% proposed by Verona Township Manager Joe Martin, and without affecting essentials, like the police or facilities maintenance. Roman’s analysis of our budget showed that Verona’s expenses have increased at three times the rate of inflation since 2008 and that municipal debt service is up 42%

since that time.

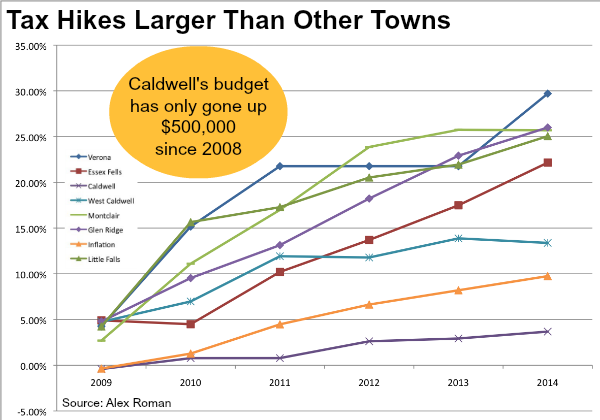

Now Roman, who ran unsuccessfully for Town Council last year, has looked at how Verona’s budget stacks up to those of neighboring towns, and the results are even more sobering. While every town around us has had budget increases in the last four years, Verona’s has risen by a greater percentage than any other town. That includes Montclair, which has a paid fire department and ambulance squad. Of the six towns that Roman analyzed outside Verona–Caldwell, West Caldwell, Essex Fells, Glen Ridge, Montclair and Little Falls–only Caldwell has kept its tax levies from rising more than inflation. Caldwell’s budget has only gone up $500,000 since 2008. (Roman was not able to get data for every town that borders on Verona.)

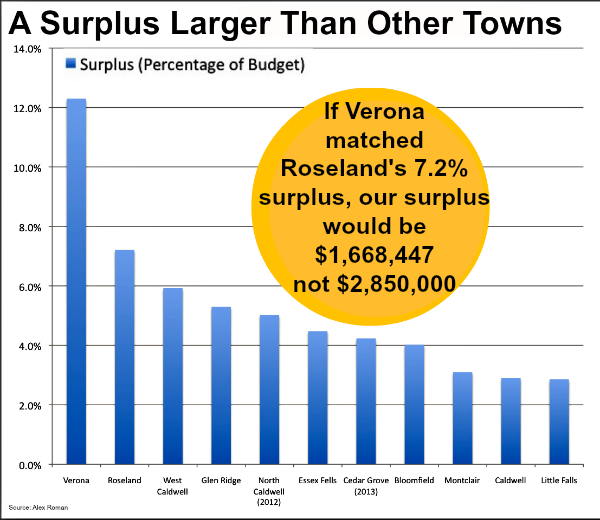

There are dozens of costs that go into any municipal budget, but Roman has been particularly concerned with the size of Verona’s surplus. which Martin has sought to maintain at $2,000,000 yearly. Roman’s analysis put the surplus at $2,978,376.35 as of December 31, 2013. The anticipated surplus in the 2014 budget is $2,850,000.

In his most recent analysis, he has learned that Verona’s surplus, as a percentage of its budget, is far higher than that of neighboring towns. Verona’s surplus is more than 12% of its budget, while West Caldwell, Glen Ridge, North Caldwell, Essex Fells, Cedar Grove, Bloomfield, Montclair, Caldwell and Little Falls all maintain surpluses of less than 6%. If Verona were to lower its surplus to a percentage equal to Roseland–which has keeps 7.2% of its budget–Verona’s surplus would fall to $1668447, a difference of $1,181,553.

Roman knows that budget change won’t happen at the flip of a switch. Because we must wait for the state to finish its budget before finalizing ours, Verona’s budget year is half over before the Town Council approves the actual budget. And he’s not for indiscriminate slashing: As someone who manages a budget larger than Verona’s for a private-sector company, Roman supports much of Verona’s capital spending, like the new 911 emergency system. His goal, as he stated last week, is “to put the township back on an appropriate financial path while retaining a sizable and well-paid staff, a substantial capital budget, and a healthy reserve fund that meets their stated objectives.”

To spur thinking ahead of the Town Council’s vote on the budget on Monday, June 2, Roman has sent his alternative budget to all five Council members. Three votes are needed to have Martin’s 6.5% tax increase pass. The Town Council meets on the second floor of Town Hall, starting at 7 p.m.

Are we missing something here? Why is our surplus larger than other towns? Wonder if this data will be swept under the rug and ignored?

What are the surplus funds in each budget used for? What is the total amount of surplus funds accumulated over the course of the years, currently sitting on the books?

Thanks.

Dear Carol,

The word surplus is misleading at best. I can assure you that there is no accumulation of funds sitting on the books or in any bank account. Surplus is simply the word given to an amount of money that is allocated for any number of line items in each year’s budget, but is not spent in that year.

At the end of the year, whatever money that was allocated for those line items but was not spent is tagged as surplus, is returned to the revenue side of the next year’s budget, and used for tax relief. I prefer to think of it as a “rolling balance” that continues to get paid forward each year.

In a 24/7 service operation, it is imperative to allocate enough funds to cover any unforeseen, and possibly troublesome situation with the hope that none, or at least few occur.

Hope this helps,

Bob Manley

Verona Township Mayor

Thanks Bob. It might also help readers if you or the Council could explain why Verona’s surplus is more than 12% of our total budget when most other towns around us are under 6%.

Carol,

The surplus anticipated in the 2014 budget is $2,850,000. From a budgetary viewpoint, the prior year surplus is the top line of our revenue budget, so it gets put back in the pot with tax dollars, ancillary revenues, shared service receipts, and other revenue. The surplus is then re-generated each year by underestimating revenues and over-allocating expense budgets.

The issue is that the surplus has grown substantially. The spread between budgeted amounts and actual amounts widens year-over-year. That is what affects taxpayers in the current year. It drives the tax levy up because the bottom line of revenues has to match the bottom line of expenses. So if you keep padding the expense lines to generate more surplus, you have to add to the tax levy to cover that increase.

The surplus increased $200,000 from 2013 to 2014. The town could have held down the tax levy in 2013 by $200,000 and ended up with a flat surplus. This would have resulted in a 1.3% lower municipal tax rate in 2013.

The surplus does not provide “tax relief”. If it remained flat, it would be tax-neutral. If it goes up, it causes taxes to increase. To provide tax relief via the surplus, we could set a hard cap on the desired surplus and consume any excess funds by holding down the tax levy, or reduce expense budget lines to prevent generation of excess surplus. The Town Manager has repeatedly stated that the goal is to generate “about $2 million” in surplus. As such, we have met and exceeded that goal and have over-taxed to increase the surplus without justification.

Alex Roman.

I should be more specific about one thing – it’s the increase in the year-end balance of the surplus that represents the excess taxes collected. That’s a different number the anticipated surplus that goes into the top line of the revenue budget. Year-end surplus balance as of December 31, 2012 was $2,793,889 and increased to $2,978,376 as of December 31, 2013. That’s an increase of $184,487.

The budget procedure to fix the surplus is to increase the anticipated surplus in the current year budget to draw down last year’s surplus balance, then lower the expense budget lines closer to their actuals to prevent the generation of excess surplus next year. Both actions will reduce the levy this year.