On September 4, Republican congressional candidate Jay Webber issued a statement entitled “Mikie Sherrill Is Lying And Fear Mongering Regarding North Jersey Property Values”, in which he takes issue with the Democratic candidate’s statements that the Trump tax plan would depress property values.

On September 4, Republican congressional candidate Jay Webber issued a statement entitled “Mikie Sherrill Is Lying And Fear Mongering Regarding North Jersey Property Values”, in which he takes issue with the Democratic candidate’s statements that the Trump tax plan would depress property values.

The Trump tax plan passed last December caps the amount of state and local taxes (SALT), including property taxes, that homeowners can deduct from their federal tax returns at $10,000. (In 2015, the most recent year for which data is available, the average SALT deduction taken by Verona taxpayers was $24,480.) Rep. Rodney Frelinghuysen (R-NJ11), who now holds the House seat that Webber and Sherrill hope to occupy, voted against the Trump tax plan because of its potential impact on his district, which includes Verona.

“The people of New Jersey already carry an extremely heavy tax burden,”” Frelinghuysen said in a statement last December. “They need and deserve tax cuts. Unfortunately, H.R. 1 caps the federal deduction for state and local taxes (SALT) which will lead to tax increases for far too many hardworking New Jersey families. This legislation will also damage our state’s housing market and business environment. I had hoped to be able to vote for a pro-growth tax bill. However, H.R. 1 forces New Jersey residents to pay for tax cuts for residents in other states. I voted ‘No’!”

Frelinghuysen wasn’t the only one to sound the alarm. “Although we are pleased with, and applaud, the business and individual tax reductions, there are many aspects of the proposal that will be extremely detrimental to our state,” said Tom Bracken, president of the New Jersey Chamber of Commerce, last fall. “The full impact of the legislation will put New Jersey into the category of one of only three to six states that will ‘lose’ after adoption. States with high income tax, high property tax and high real estate values will be hardest hit by the bill. New Jersey qualifies in all three categories.”

In his press release, Webber shares an infographic from Sherrill’s Twitter feed that indicates the tax plan would cause a 10.5% drop in home values in Essex County. Webber then points to a New York Times article of August 27, which he says “debunked the notion that tax reform has hurt the housing market.”

Sherrill’s infographic sources its statistics to Moody’s Analytics, and a Sherrill campaign spokesperson sent a link to a feature on Slate.com in which the statistics appear. But Slate appears to have gotten the percentages wrong. Moody’s Analytics provided MyVeronaNJ.com with its actual data and the drop in Essex County was projected to be greater, 11.3%. Moody’s Analytics projected where home values might have been had the tax changes not been enacted, and showed the decrease or increase to that point. Moody’s Analytics is a risk assessment company that is a sister company to the bond credit rating business Moody’s Investors Service.

Moody’s Analytics predicted a sharply negative impact from the tax plan not only in Essex County but in the three other counties that are part of New Jersey’s 11th congressional district. In Morris County, which constitutes the bulk of the district, Moody’s predicted a drop of 9%; in Passaic the drop was 9.8% and in Sussex it was 8.2%. The impact was far less negative in many states with Republican majorities, and Moody’s predicted that some of the counties in those states could actually expect a gain in home prices.

The New York Times article Webber uses in his statement uses data from Redfin and Zillow that indicates that home prices are rising, not falling in many markets. Webber also included the July 2018 report from New Jersey Realtors, which also shows an increased in median sale prices. Neither the Times article nor the trade group had data specific to the same four counties as the Moody’s Analytics Report, however.

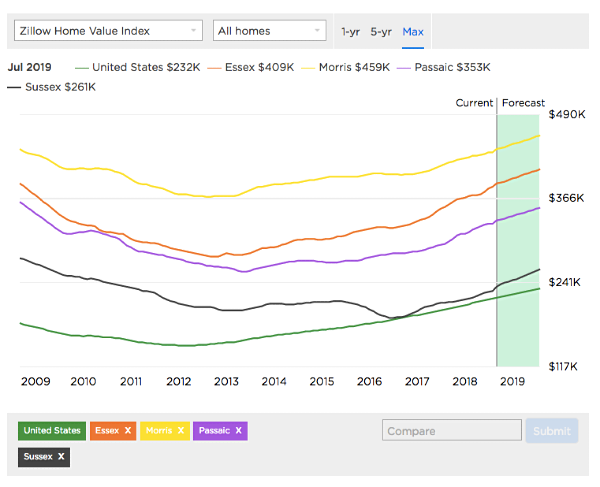

Online, Zillow’s Home Value Index can display home value information by county. The screenshot above shows that while home values in the four NJ11th counties have been rising, they have not yet returned to their levels of 2009. Zillow predicts that Essex and Morris counties could top the 2009 level in 2019, but that Passaic and Sussex counties will still be below. We should also note that the boundaries of NJ11 do not include every town in each of the four counties, and limiting a value analysis to just the towns that are part of the district could produce different results.

(Local market data compiled by the Garden State Multiple Listing Service (GSMLS) indicates that the average listing price in Verona was higher in July than in January this year. GSMLS data also indicates that the average percentage of sales price to list price has risen steadily since January and is now above 100%.)

The Webber release then goes on to tout the increased valuation of Sherrill’s own Montclair home as proof that values are not falling, but fails to include one important detail: Before the Trump tax plan was introduced, the Essex County Board of Taxation had directed towns to revalue properties to bring them to market value. Montclair did its reval in early 2017 (Verona’s is now underway), and the assessment on Sherrill’s home increased to $1,895,400 from $1,536,300, an increase of 23%. Prior to the reval, Montclair homes had been assessed at only 80%, roughly, of their market value.

Even once a home is at what a tax assessor considers market value, it can be listed for more. Many area homes that have gone on the market this year have been listed at 15% above their assessed value, which is how Sherrill’s home is listed for sale now. Its address is just outside the boundaries of the 11th district and, while a candidate need not be a district resident to run for election, once elected, officials must be in district.

BOTTOM LINE: Home values in the four counties that are part of the NJ11 congressional district do not appear to have declined yet as a result of the Trump administration’s changes to the deductibility of property taxes. But it is false to claim that Sherrill was lying about the projected impact. Her campaign relied on Moody’s Analytics, a generally respected data source. As the statements from Frelinghuysen and the state chamber show, she has hardly been alone in anticipating a negative impact from the Trump tax plan. And while some Republican lawmakers have previously indicated that they wanted to introduce legislation in September to make the SALT cap permanent, others are telling tax news reporters that that could be detrimental to Republicans in tight blue-state races.

Soooo…Sherrill isn’t “lying” about projected decrease in property values because all she she did was present a dated and demonstrably wrong Moody’s Analytical forecast?

Yikes!