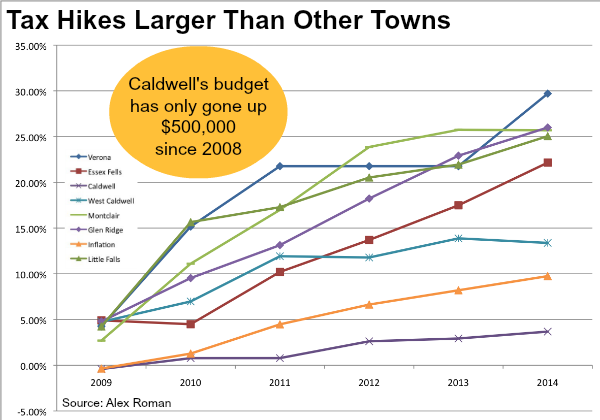

Manley insists that the town uses PILOT money for either tax relief or tax avoidance, “to help defray the rising cost of infrastructure upkeep, and materials and services which benefit the entire community.” And that could be a good thing: From 2009 to 2014, Verona’s taxes rose almost 30%, while Caldwell’s rose less than 5%.

So, could the PILOT money be shared with the BOE? At the last Town Council meeting, Councilman Jay Sniatkowski took issue with the suggestion, saying that a decision to that effect by the current Council would improperly encumber future Councils. But the Hilltop PILOT committed Verona to a revenue structure through 2043 on the assumption that the Hilltop buildings would be age-restricted housing. School children live in them now and could in the future.

The Boxer report amply documented how New Jersey school districts get shortchanged by PILOTs and noted that other governments do share PILOT monies and decision making: Five states, including Pennsylvania, give school boards formal decision making power over the granting of any abatements, three states require school boards to be notified of any pending abatement decisions and two states require a school board representative on any abatement advisory body. In 10 states, a school board can negotiate its own PILOT with a developer. Boxer’s recommendations have not been implemented.

And what of future PILOTs? In January, the Town Council decided that the former Brunner lots were an area in need of redevelopment and it could face a vote soon on a similar designation for the former Annin factory. Such a designation makes it possible for a developer to seek a PILOT.

Ryan is approaching that decision cautiously. “We need to see some actual numbers before any final decisions are made,” he said. “What revenue is the Board of Ed currently getting from the properties being considered? What are the short- and long-term consequences of the PILOT abatements? What factors go into developing the payment schedule and the length of time the agreement? Should the developer be required to reimburse the municipality for any outside independent consultant costs to ensure the fairness of the process? I wasn’t on the council when the Hilltop apartments PILOT was approved so I need an education on these issues.”

Mark Twain once said, “Some people use statistics like a drunk uses a lamppost; for support rather than illumination.” The above, undocumented, unverified graph that shows Verona’s property tax rising 30% since 2009, while Caldwell’s has only risen 5% is misleading at best, and an unfair comparison for a number of reasons. Each municipality is responsible for collecting 100% of your property tax. On average, 55% of Verona’s goes directly to the Board of Education, and 20% goes directly to Essex County. This leaves the Township roughly 25 cents on the dollar to run your town.

A comparison done in the fashion of the above graph is simply an example of apples to oranges. All towns provide different services, have different revenues, and have a different tax basis (residential vs. commercial) to pay for the essential services they provide.

The unverified graph by Mr. Roman chosen to be presented in this article offers no detail or support, and it is unknown from where his statistics are derived. It is obvious that he did not use the municipal tax levy which is a much truer example of what the Township Council has within its control. The municipal tax levy is set strictly by the Council, and while still driven by certain fixed costs, it does not fluctuate with the economy or other external influences.

Back in 2010 when the national economy was in such dire straits, the Township Council heard the real and troubling concerns of our residents and came in with a flat tax levy, a 0% increase for the next 3 years. For 2010 to 2011, 2011 to 2012, and 2012 to 2013, the money to be raised by taxation for the municipality portion of your total property tax did NOT increase.

According to the above graphed municipalities’ own official websites showing the tax levy % increases from 2010 through 2014, an illuminating truth is revealed. Caldwell’s municipal tax levy actually increased by only 2%, West Caldwell’s by 5.98%, and Verona’s by 11.75%. However, Montclair increased by 13.3%, Glen Ridge 14.8%, Essex Fells 16.91%, and Cedar Grove by 18.58%.

A quick look at Caldwell’s audit report highlights three key reasons why they are lower than Verona’s.

1. Caldwell’s Miscellaneous Revenue Anticipated accounts for over 40% of their budget, which leaves only 60% to be raised by taxation.

Verona’s Miscellaneous Revenue only accounts for about 20% of our budget, half of Caldwell’s, leaving 80% to be raised by taxation.

Caldwell’s Community Center brings in just under $2,000,000 a year as it is run like a fitness club charging membership fees.

The Verona Community Center generates about $70,000 derived from rental of the

banquet room. It is predominantly used to facilitate Township recreation programs.

2. Caldwell pays 48% of property tax to their BoE compared to Verona’s 55%.

3. Caldwell has a substantially greater percentage of a commercial to residential tax base compared to that of Verona.

The Payment in Lieu of Tax program is a good thing, particularly for municipalities the size and demographic of Verona. It allows the township to maintain the delivery of essential services, and implement needed projects, programs and facilities while keeping the municipal portion of your property tax low. Please feel free to contact me if you wish to further discuss any concerns you may have.

Mayor Bob Manley

[email protected]

Mayor Manley,

Thank you for your comments.

First, the quote you refer to is generally attributed to Andrew Lang. Mark Twain may have said many memorable things but that is not one of them.

The graph I prepared is based on the municipal tax levies of each of the municipalities shown. I pulled the state form municipal budgets from each of their websites for all years available at the time of preparation of this data. The numbers graphed are the cumulative percentage increase over a 2008 reference year for the value on Sheet 11, Line 6, “Total Amount to be Raised by Taxes for Support of Municipal Budget”, FCOA 07-199.

You state that Verona did not enact a tax increase for the 2010 – 2011 time period. That is incorrect.

In 2010, the total municipal levy was $14,059,373. In 2011, it was $14,865,208. From 2011 to 2012 and from 2012 to 2013 it did not increase from that $14,865,208 amount until the originally proposed 2014 tax levy hike to $15,833,811, later brought down to $15,710,811. Thus, we were hit with a 5.73% tax increase in 2011 and a 6.52% increase was originally proposed for 2014, finalized at 5.69%. You voted to approve those increases.

I will agree that under intense public pressure the Township did limit the rise in its tax levy for a two-year period of time followed by a significant tax hike in 2014. We have still increased the levy at three times the rate of inflation over a 2008 reference year. That to me remains unacceptable financial performance and a real increase on the burden placed on citizens.

Alex Roman

The quote is actually derived from 1903 writing by H.E. Housman, but yes, I stand corrected. It is most attributed to Andrew Lang. Thank you Alex.

However, I stand by every other comment made in my response. The Verona Township Council did not increase the amount of municipal spending to be paid by taxation for 3 consecutive years. As I previously stated, there are many fixed cost drivers, more than most people realize, that are beyond the control of the Council. I also stand by what I have said since I initially ran for Council six years ago; I firmly believe that the vast majority of Verona residents would rather see their Council endeavor to keep taxes as low and consistent as possible, but without sacrificing the delivery of essential services they have come to enjoy and upon which they rely.

My apologies to Mr. Lang

Bob Manley